Do you pay taxes to the State of Arizona?

If so, you probably can support our children and their families by taking advantage of an Arizona tax credit called Arizona’s Tax Credit for Qualifying Charitable Organizations (QCO). It will help you reduce your state tax liability and help our children and families at the same time.

The maximum credit is $400 for single taxpayers and $800 for married taxpayers filing

jointly. You can take this credit in addition to other Arizona Tax Credit opportunities such as the private and public school tax credits.

PLEASE check with your tax professional to be sure this credit is right for you. We do NOT imply or give tax advice!

Or, make a check payable to A Stepping Stone Foundation and mail to:

A Stepping Stone Foundation

PO Box 87149

Phoenix, AZ 85080-7149

For any and all tax advice, please consult with your tax professional. Additionally, more details can be found on the Arizona Department of Revenue website at:

https://www.azdor.gov/TaxCredits/QualifyingCharitableOrganizations.aspx

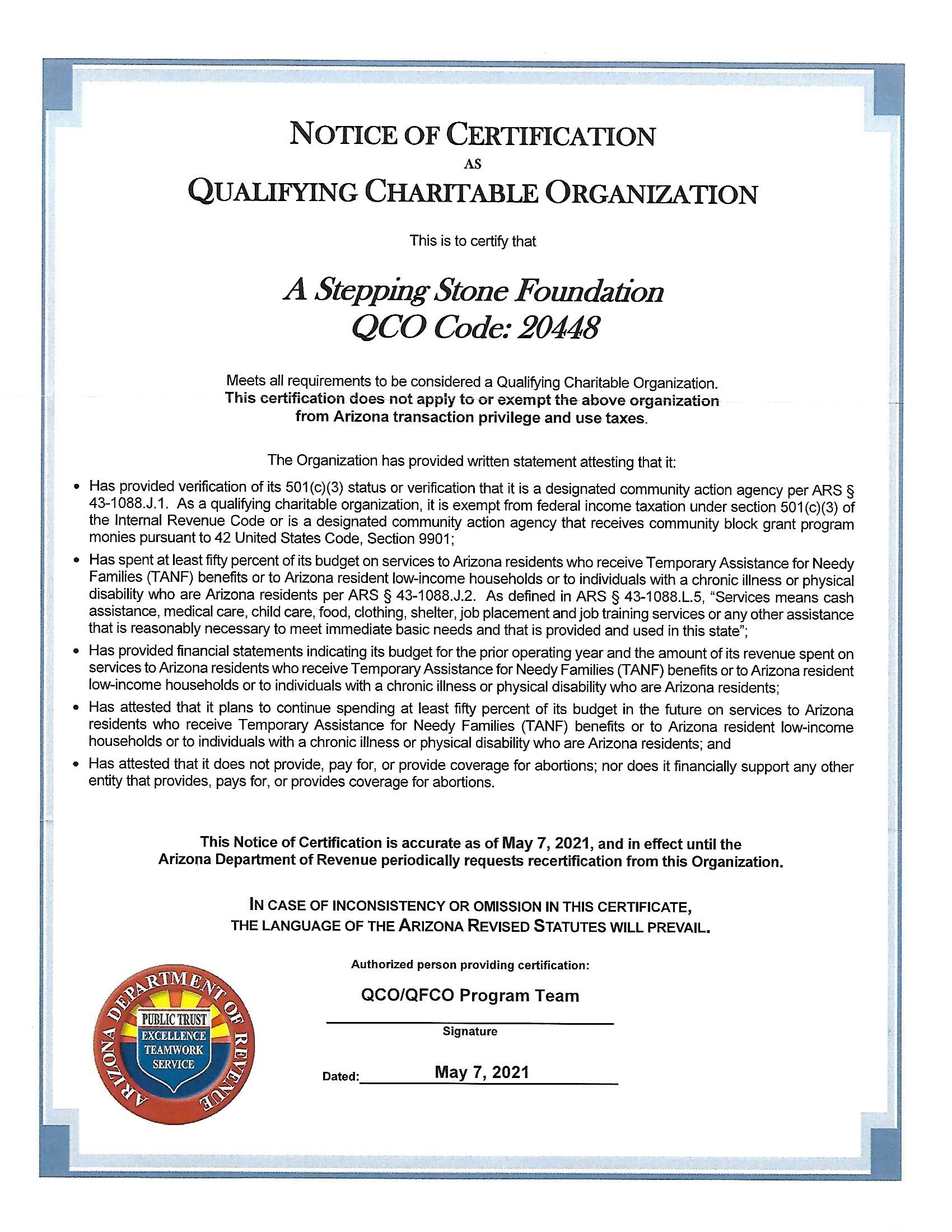

We are on the list of QCO’s at:

https://azdor.gov/sites/default/files/media/CREDITS_2020_qco.pdf You’ll find us in the “S”s. Our QCT Code # is 20448.